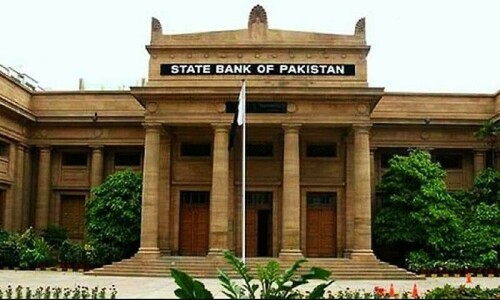

KARACHI: Bears controlled the Pakistan Stock Exchange (PSX) for the third consecutive session this week as shares shed more than 400 points following the the State Bank of Pakistan (SBP)’s decision to maintain its key policy rate.

The benchmark KSE-100 index traded in the red during the day, with the index closing at 70,657.64 — down by 444.90 points or 0.63 per cent from the previous close of 71,102.54.

Yousuf M Farooq, director of research at Chase Securities, said, “the market experienced a correction and profit taking following the decision by the SBP to maintain rates, hinting at a potential prolonged period of rate stability due to concerns regarding anticipated tax hikes and adjustments in the forthcoming budget.”

Previously, the SBP chose to maintain the status quo by upholding the key policy rate at 22 per cent for the seventh policy meeting in a row.In a statement, the MPC said the continuation of the current monetary policy stance, with significant positive real interest rates, was necessary “to bring inflation down to the target range of 5-7pc by September 2025”.

Furthermore, he said that “inflation for the month stood at 17.3pc year-on-year (YoY)” and negative 0.4pc month-on-month (MoM) “and is firmly on the downtrend which increases the chance of rate declines going forward”.

Earlier today, data from Pakistan Bureau of Statistics (PBS) showed that the country’s consumer price inflation slowed to 17.3pc in April.

Farooq noted that the market was also going through a correction. “Additionally, it’s noteworthy that the market has undergone a substantial rally in recent months. This correction has coincided with the conclusion of the corporate earnings season and a dearth of positive catalysts.”

He highlighted that despite the downward trend, “there was some traction observed in cement stocks subsequent to the release of the inflation figures.“The market remains cheap and earnings for cyclicals are expected to recover as the economy gradually rebounds,” he said.