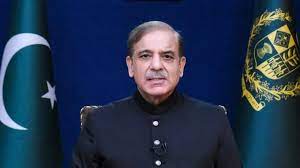

Reiterating his commitment to put the country on the path of prosperity and development, Prime Minister Shehbaz Sharif said that Pakistan has the potential to outperform India or even a greater economy with hard work.

His remarks came as the cash-strapped country’s tax evasion (revenue gap) was estimated to be around Rs5.8 trillion on an annual basis of fiscal year 2022-2023, which makes 6.9% of the GDP, according to The News.

On the other hand, India collected a record $25.15 billion as gross goods and services tax (GST) in April, recording a 12.4% surge from the same period last year, New Delhi claimed this week, Reuters reported.

Addressing a ceremony to award shields to the honest, hardworking and efficient officers of the Federal Board of Revenue (FBR), PM Shehbaz said that the country had the potential to collect revenues of over Rs24 trillion against the annual tax target of Rs 9.4 trillion.

He said an amount of around three-time of the annual revenue target was ‘going down the drain’ due to corruption, inefficiency and negligence.The premier said that the nations which believed in reward and punishment made progress.

Pakistan was facing various challenges, the premier said, adding: “Revenue collection is a big challenge. Neighbouring countries are far ahead of us.”Lashing out at the corrupt practices, the country’s chief executive said: “Recoveries that should add to the national exchequer are prone to corruption and fraud.”

“We are compelled to seek loans and approach IMF.”Hinting at harsh accountability in the FBR, the premier said: “We will ‘separate the white from the black’ on the reports of agencies and the input of the organisation.”

“Justice is decided on the basis of merit,” the PM said, adding that the the government would not show leniency to the corrupt officers.“Shields are awarded [to the FBR officials] on merit.”Promotion would be given to the official on the basis of merit, he vowed.

As regards the amount worth Rs 2.7 trillions held up across various appellate forums, including commissioners’ appeals, Appellant Tribunal Inland Revenue (ATIR) and various courts, he said now the law had been made to recover such amounts.